DOWNLOAD: Download individual Excel files by clicking on the links for particular files in the following spreadsheet descriptions. Click on the link to download the Excel spreadsheet file to the location that your computer saves downloaded files (e.g., "download" directory on Windows, etc.). To edit and save your data, the version of Excel on your computer may require you to click on "Enable Editing" if it says "Protected View" at the top of the screen when you first start the spreadsheet.

|

Revision notes for the V.0.27.03-01-18-2017a. Updated 2017 tax-tables data

in 2. TaxData worksheet. Added optional 529 education accounts worksheet. The

529 data was then integrated into the S.Setup S.2, 11. CashData Worksheets. Tables

and graphs were added to R. Results R.5.3 to refect the new optional 529Data

worksheet. Added additional references to the RS. Resources. The 11. CashData

subtables 11.1, 11.2 and 11.3 were reorganized to handle the additional optional

529Data entries. Added additional subsections in Appendix B B.5.2 expenses

calculator to let you add entries and also compute both working and retired

expenses.

Revision notes for V.0.25.02-10-02-2016a. Added optional alternate

COLAs for S1 and S2 in the 10. ExpensesData 10.2.1 irregular expenses data entry

table. This lets you specify COLAs for expenses that you expect to have a much

higher or lower COLAs than the default expense COLA specified in 10.1.2. If the

alternate COLA value specified is 0%, it defaults to the default expenses COLA.

An example might be future college costs that may be on the order of 5%. Some

COLAS may even be negative. Values of the S1 and S2 alternate COLAs not zero

are flagged with a green background. Also, fixed non-critical retirement age

display link in 10.1 ExpensesData "S2" yearly expenses after retire at age".

Revision notes: for V.0.24.17-09-22-2016c.

Changes were made based on some initial feedback from Bogleheads.org. The FAQ was

edited and added entry 16. "Why are there separate COLAs for various income

sources Work, Pension, Social Security and Annuities worksheets?". Added optional

COLA override for the Work and Annuity data. Otherwise it uses the CPI. The

TODO-List was updated for clarity. The ease of navigation to the Results worksheet

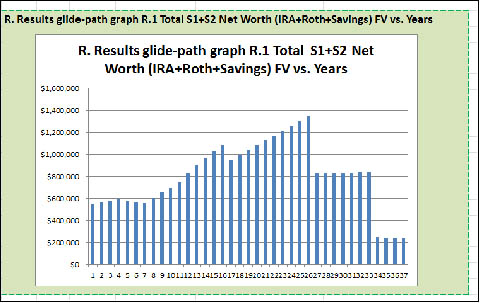

was improved from all data entry worksheets. A dynamic total summary net worth

glide-path results graph was added to each editable data entry worksheet so users

may immediately see the results of any changes they make to the data as shown in

this screenshot: